Are you looking for a secured loan that offers competitive rates and flexible repayment options? Look no further than Virgin Money Secured Loans.

With fixed and variable rate loans, they provide easy eligibility checks with their bespoke panel of UK lenders.

Whether you’re looking to buy a house or flat, refinance your current mortgage, or take out additional borrowing on either a repayment or interest-only basis – Virgin Money has the right option for you.

Explore our overview of Virgin Money Secured Loans today to learn more about the types available, interest rates offered and other considerations before deciding.

A new product from 1st February 2023, unavailable on the comparison engine sites, Virgin Money secured loans.

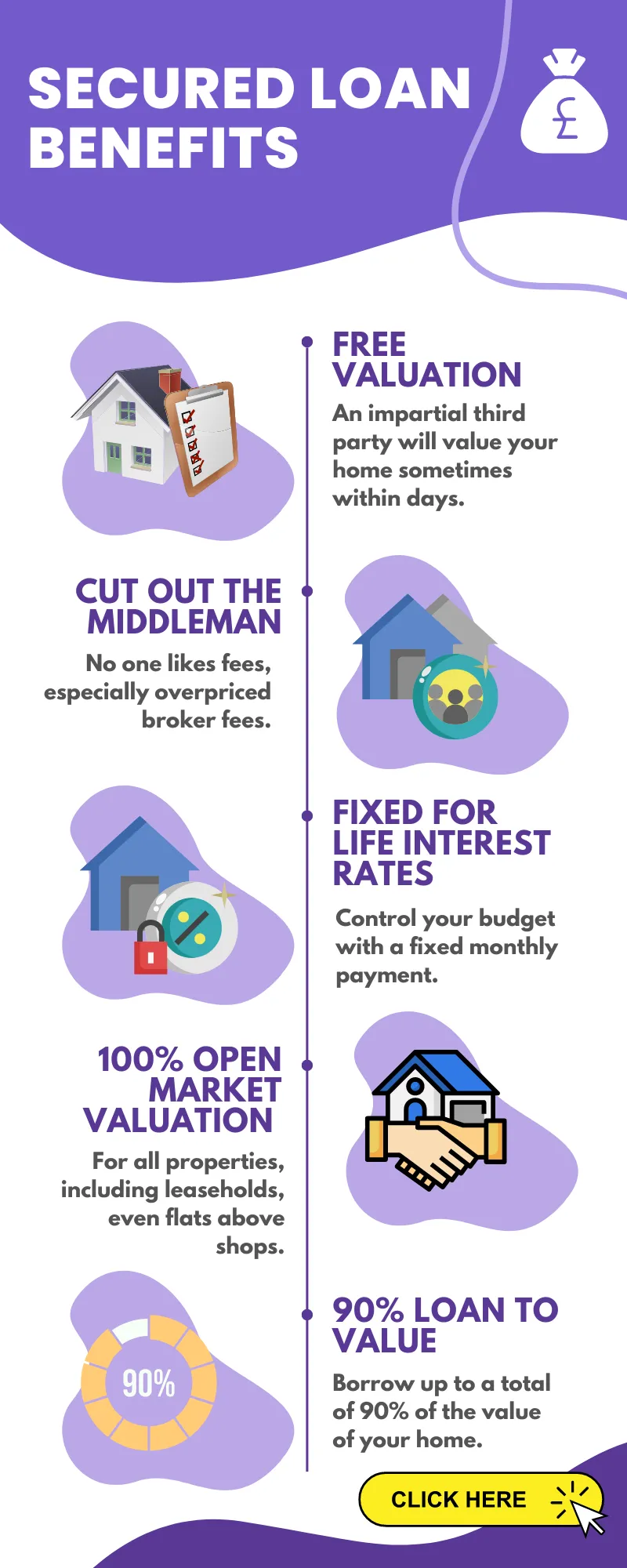

- Loan to value up to 90%

- You don’t need to be an existing Virgin Money customer

- A free no, obligation 3rd party property valuation

- 6.1% fixed for life

- Flats and other leaseholds have full open market valuations applied

- Keep your existing mortgage

- The term can be matched to your existing mortgage for up to 25 years

- No arrangement, product or completion fees

- No early redemption penalties

- Fast agreement in principle based on soft credit search that has no impact on your credit history

Please complete the initial no-obligation enquiry form:

Overview of Virgin Money Secured Loans

A loan that necessitates a borrower to furnish an asset as security to acquire the credit is referred to as a secured loan.

Collateral can be any asset of value, such as property, jewellery, or vehicles. In exchange for providing this collateral, lenders offer lower interest rates and longer repayment terms than unsecured loans.

Virgin Money Secured Loans are designed specifically for homeowners who need additional funds but don’t want to take out an unsecured loan due to its higher risk and cost.

Virgin Money Secured Loans come with plenty of attractive benefits:

- Low fixed and variable rates starting from 3% APR

- No early repayment charges should you decide to pay off your loan ahead of schedule

- Flexible repayment options offering up to 30 years on residential loans or 25 years on buy-to-let loans

- Access up to £100k based on personal circumstances.

Furthermore, they provide competitively priced insurance products that can offer protection in case something unforeseen happens during the agreement.

Overall, Virgin Money Secured Loans offer an excellent opportunity to access additional funds with the security of your home. Next, let’s explore the various secured loan offerings from Virgin Money.

Types of Virgin Money Secured Loans

Virgin Money offers two types of secured loans – a residential additional borrowing loan and a buy-to-let (BTL) additional borrowing loan. Both are designed to help individuals in the UK who own a house, flat or commercial property access extra funds for their projects.

Residential Additional Borrowing Loan:

This type of secured loan is available to homeowners looking to raise money for home improvements, renovations or other personal expenses. It can be used as an alternative to remortgaging and allows you to borrow up to 90% of your home’s value with no early repayment charges.

The interest rate is fixed, so you know exactly what you’ll pay each month over the term of the loan, making it easier for budgeting purposes.

If you own a buy-to-let property, Virgin Money’s BTL additional borrowing loan could be just what you need if your existing mortgage isn’t enough.

With this loan, landlords can obtain up to 85% of their rental property’s value with varying repayment terms between one and 25 years, providing more flexibility. Interest rates on these loans are variable but remain competitive compared with other lenders today.

Interest Rates for Virgin Money Secured Loans

Interest rates for Virgin Money Secured Loans vary depending on the type of loan. The interest rate is a Standard Variable Rate (SVR) plus 1% for residential additional borrowing loans.

Monthly payments are determined by an interest rate which can vary, and you’ll be informed of any alterations to the amount before they occur.

The SVR is typically higher than other loan options, but it does provide more flexibility if your financial circumstances change.

For Buy To Let (BTL) Additional Borrowing Loans, the interest rate is a Buy To Let Variable Rate (BTL VR) plus 1%.

This fixed-rate option provides peace of mind as your repayments remain constant throughout the life of the loan, and you won’t have to worry about sudden increases in repayment amounts due to fluctuating market conditions.

However, this option may not suit everyone as it requires a larger initial deposit than other secured loan products.

When selecting a Virgin Money Secured Loan, it is imperative to assess all immediate and long-term costs before settling on a choice.

Factors such as eligibility requirements should also be considered when deciding whether taking out a secured loan is the right option.

The interest rates for Virgin Money Secured Loans are competitive and can provide an excellent option for those looking to take out a loan. Furthermore, multiple payment plans are obtainable to explore in the subsequent section.

Repayment Options for Virgin Money Secured Loans

Repayment Basis Option:

When taking out a Virgin Money Secured Loan, borrowers can repay their loan on a repayment basis. This means that each month, borrowers will pay back the interest and capital of their loan in one single payment.

By selecting the repayment basis option, borrowers can save money by lowering their total interest costs and decreasing the amount they owe over time.

Alternatively, Virgin Money also offers an interest-only basis option for secured loans. With this choice, borrowers will need only to pay the interest accumulated on their loan each month and not any of the principal balance.

This is ideal for those who wish to keep their monthly repayments lower but should be aware that it may take longer to pay off their entire debt if opting for this repayment plan and could end up costing more in terms of total interest paid over time due to compounding effects.

Repayment Options for Virgin Money Secured Loans offer flexibility and convenience, allowing customers to tailor their loan repayment plans according to their financial needs.

Moving on from this topic, other considerations, such as additional policy restrictions, may apply when taking out a secured loan with Virgin Money.

Other Considerations for Virgin Money Secured Loans

When taking out a secured loan with Virgin Money, there are certain policy restrictions that borrowers should be aware of. These additional restrictions may include minimum and maximum loan amounts; credit score requirements; property value caps; and age limits.

For instance, if you want to apply for a secured loan, the sum should be between £10k and £150k. To be eligible for this loan, your property must have an estimated market value of no less than £75,000.

Applicants should know that eligibility requirements may vary depending on whether they are applying for a BTL or Residential Additional Borrowing Loan from Virgin Money.

Generally speaking, though, applicants must be aged 18 or over and hold UK residency status and have an acceptable credit history to qualify for either type of loan from Virgin Money.

The interest rates Virgin Money offers can vary depending on which type of secured loan you opt for – Standard Variable Rate (SVR) Plus 1% or Buy To Let Variable Rate (BTL VR) Plus 1%.

The SVR rate applies to residential loans, while the BTL VR rate applies specifically to buy-to-let mortgages where rental income will be used as part of payment towards the debt each month.

Repayment options also differ depending on what kind of secured loan you choose from Virgin Money – repayment basis option or interest-only basis option being two examples available.

Repayment plans are usually flexible, but they can sometimes involve higher monthly payments than other types of loans. Hence, it’s important to consider this before deciding how much money you want to borrow through this lender.

Finally, it is worth noting that some lenders may require additional security, such as guarantors, when considering applications for these kinds of loans. Therefore, ensure to thoroughly scrutinize all the stipulations before consenting.

Conclusion

In conclusion, Virgin Money secured loans offer an ideal solution for those looking to take out a loan with fixed and variable rates.

With competitive interest rates, flexible repayment options and additional policy restrictions that may apply, it is worth considering if you need extra funds.

When choosing your lender, research and compare the different offers available to find the best deal that suits your needs.

Take control of your finances today with a Virgin Money secured loan. You can find the perfect solution for your financial needs with competitive rates and easy eligibility checks.

Virgin Money Contact Details:

Registered Office:

Jubilee House

Gosforth, Newcastle upon Tyne,

NE3 4PL

United Kingdom

Registered Number: 09595911

Financial Services Register number: 305065

https://www.virginmoneyukplc.com/