Are you in need of a safe borrowing solution? TSB secured loans could be the answer. With fixed and variable rates available, finding an affordable solution with TSB is easy.

Their fast and simple eligibility check makes accessing funds easier when needed. Whether you’re an existing or new customer, discover how taking out a TSB secured loan can help get your finances back on track today.

A new product from 1st February 2023, unavailable on the comparison engine sites, TSB secured loans.

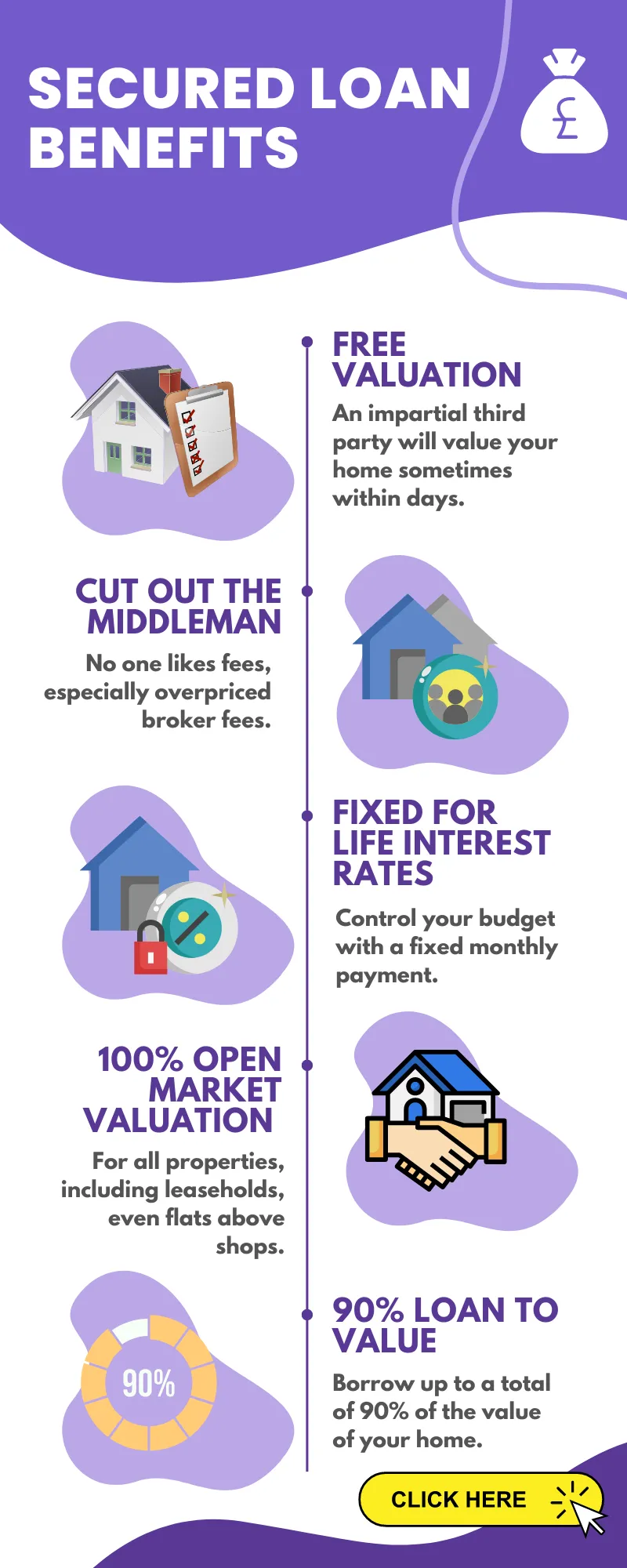

- Loan to value up to 90%

- You don’t need to be an existing TSB customer

- A free no, obligation 3rd party property valuation

- 6.1% fixed for life

- Flats and other leaseholds have full open market valuations applied

- Keep your existing mortgage

- The term can be matched to your existing mortgage for up to 25 years

- No arrangement, product or completion fees

- No early redemption penalties

- Fast agreement in principle based on soft credit search that has no impact on your credit history

Please complete the initial no-obligation enquiry form:

What are TSB Secured Loans?

TSB secured loans are a great way to finance large purchases or consolidate debt. They are available in two types: fixed rate and variable rate.

Fixed rate loans have an interest rate that remains the same throughout the loan term, while variable rates can fluctuate depending on market conditions.

Collateral, like a home or other asset, must be provided to guarantee the loan against potential non-payment for either fixed rate or variable rate loans.

Fixed Rate Loans offer stability and predictability when it comes to repayment terms since the interest rate stays constant for the entire duration of the loan term.

This makes them ideal for those who want certainty regarding their monthly payments over a longer period of time – up to 25 years with TSB Secured Loans.

The downside is that you won’t benefit from any savings if interest rates fall during this period.

Variable Rate Loans offer more flexibility than fixed-rate options because they allow borrowers to take advantage of changing market conditions by adjusting their repayment amounts accordingly.

As with fixed-rate loans, however, these come with risks; if market rates rise during your loan term, so too could your monthly repayments – making budgeting difficult.

Variable-rate loans may come with a more significant financial burden due to the higher associated fees compared to fixed-rate options.

Benefits of taking out a TSB Secured Loan include access to larger sums than unsecured personal loans (upwards of £25k) and competitively low APR rates – typically between 3% and 7%.

Furthermore, you may also be able to qualify even if you have a poor credit history or limited income/assets. Due in part because lenders view secured borrowing as less risky than unsecured lending since there is something tangible backing up the agreement should anything go wrong along the way.

TSB Secured Loans are an excellent option for those looking to borrow money against their property, offering competitive rates and flexible repayment terms.

Eligibility Requirements for TSB Secured Loans

Secured loans with TSB require borrowers to meet certain eligibility requirements. When seeking a loan from TSB, one’s credit rating, salary, job standing, and possession of the property are all aspects to be assessed.

Credit Score Requirements:

Applicants must have an acceptable credit score to qualify for a secured loan with TSB. This is determined by looking at past payment history and credit utilization. Applicants should have no recent missed payments or defaults on their record to be approved for the loan.

Income and Employment Requirements:

Borrowers must also demonstrate sufficient income to qualify for a secured loan from TSB. A minimum monthly salary of £1,000 is required before taxes and proof of steady employment over the last three months.

For self-employed applicants, extra paperwork such as tax returns or bank statements may be needed to confirm repayment capacity.

Property Ownership Requirements:

The final eligibility requirement relates to property ownership – only homeowners can apply for secured loans with TSB Bank UK Limited (TSB).

To be considered for a secured loan with TSB Bank UK Limited, applicants must demonstrate ownership of a residential or commercial property via title deeds or mortgage documents.

By meeting these criteria, potential borrowers can take out a secured loan from TSB Bank quickly and easily without any hassle or delays due to inadequate paperwork being provided during the application process.

To be eligible for a TSB secured loan, applicants must possess specific credit ratings, salary and job qualifications, and ownership of the asset utilized as security.

It is important to consider all repayment options available before taking out a loan, including fixed-rate, variable-rate, and early repayment options.

Repayment Options for TSB Secured Loans

TSB secured loans offer a range of repayment options to suit different budgets and needs.

Fixed repayment plans can provide a sense of security for those who wish to know their monthly payment amount. At the same time, variable rate arrangements may prove advantageous if interest rates fall in the future.

Early repayment options are also available for those who want to pay off their loan sooner than expected.

Fixed Rate Repayment Plans:

Fixed rate repayment plans provide borrowers with certainty regarding monthly payments as they remain unchanged throughout the life of the loan.

This plan is ideal for those with a steady income who can confidently make the same payments every month without any unexpected shifts.

The fixed interest rate means that borrowers won’t be affected by market changes which could otherwise cause their payments to increase or decrease unexpectedly.

Variable rate repayment plans can offer potential savings should rates decrease, but there is a risk of higher payments if they increase – something to consider before committing.

Budgeting could become more complicated depending on how much additional income is available from other sources, such as wages or investments.

Before committing to a variable rate repayment plan, it is important to consider all available options and their potential impacts on your budget.

Repayment options for TSB secured loans provide a variety of repayment plans to suit your needs and budget, so you can rest assured that an option is available to fit your circumstances.

With the advantages of taking out a TSB secured loan, including low-interest rates and fees, flexible terms and conditions, and a fast approval process, it’s clear why this type of loan may benefit many UK homeowners.

Advantages of Taking Out a TSB Secured Loan

Taking out a TSB secured loan has many advantages for UK homeowners. The appeal of a TSB secured loan lies in its competitive rates and charges, rendering it an affordable choice for those seeking to acquire funds rapidly.

With fixed or variable rate repayment plans, borrowers can choose the best plan that fits their budget and lifestyle.

The loan conditions are adaptable, making it possible to modify payments without additional costs. The approval process is speedy; in most cases, you will have your funds within a day after submitting the application.

Low Interest Rates and Fees:

Secured loans from TSB offer competitive interest rates compared to other lenders in the market.

Depending on your credit rating and earnings, you may be eligible for even more economical rates than advertised – an excellent choice for those with good financial standing who require prompt access to funds.

In addition to low-interest rates, no additional fees are associated with taking out a secured loan from TSB – meaning more money stays in your pocket over time.

During the repayment period, those who may experience unforeseen financial hardships, such as job loss or illness, can rest assured that TSB’s secured loans offer flexible terms and conditions.

This means they can easily modify their payment schedule without incurring additional charges or penalties – a real boon for those needing breathing room.

Furthermore, with no extra fees associated with taking out a loan from TSB, more money stays in your pocket over time.

So, taking out a TSB secured loan offers many advantages, such as low-interest rates and fees, flexible terms and conditions, and a fast approval process.

Despite the advantages of a TSB secured loan, there are some drawbacks to consider before committing.

Disadvantages of Taking Out a TSB Secured Loan

Obtaining a TSB secured loan could be advantageous for obtaining the money you require. However, there are certain drawbacks which borrowers should evaluate before deciding.

The potential downside of a TSB secured loan is the danger that lenders could seize your house if you cannot pay back what you owe. If you fail to make payments, lenders could seize your property as recompense for the loan.

Another potential downside to securing a loan with TSB is higher interest rates compared to unsecured loans.

Due to the increased repayment safety, lenders may impose higher interest rates than those found with other loan options, such as personal or business loans. Higher interest rates result in more costly repayments over time when compared to unsecured loans.

Finally, another disadvantage of taking out a TSB secured loan is longer repayment periods, making budgeting difficult for some people.

With a longer loan term, the monthly payments are usually lower; this also results in paying more for interest over time – something to consider before committing.

FAQs concerning Tsb Secured Loans

What are the eligibility requirements for TSB secured loans?

TSB secured loans require applicants to be 18 years or older, a UK resident and a homeowner.

They must have an income of at least £10,000 per year and hold a current account with TSB Bank. Additionally, the property used as security for the loan must not exceed 75% of its value. All applicants are subject to credit checks by TSB Bank before any loan is approved.

What is the maximum loan amount available through TSB secured loans?

TSB secured loans offer a maximum loan amount of up to £50,000. This is subject to an individual’s creditworthiness and affordability assessment by the lender.

Before obtaining a loan from TSB, applicants must satisfy the necessary requirements and remember that interest rates may be contingent on their situation.

Are there any fees associated with taking out a TSB secured loan?

Yes, there are fees associated with taking out a TSB secured loan. These include an arrangement fee of up to £1,500 and a completion fee of up to £100. In addition, interest may be payable from the moment funds are disbursed until the first repayment is due.

Considering all costs before applying for any loan product is important, as these can add significantly to the overall cost of borrowing money.

How long does it take to get approved for a TSB secured loan?

TSB secured loans are designed to be quick and easy, with the approval process typically taking just a few days. Once you have submitted your application, TSB will assess it quickly and provide an answer within 24 hours.

Nevertheless, depending on the intricacy of your situation, some requests may take more to be accepted. In these cases, TSB will contact you directly if they require any additional information or documents before deciding.

Does TSB offer fixed or variable rate options on their secured loans?

TSB offers both fixed and variable rate options on their secured loans. The fixed rate option offers a set interest rate over the loan’s term, while variable rates can fluctuate during its life.

Customers can also choose between a repayment or an interest-only plan for either type of loan. Both options come with competitive rates and are subject to TSB’s credit criteria.

Conclusion

In conclusion, TSB secured loans can be an excellent option for individuals living in the UK who own a house, flat or commercial property and are looking to take out a loan.

With fixed and variable rates available, fast eligibility checks with bespoke lenders panels from across the country and repayment options that suit individual needs – taking out an TSB secured loan could be just what you need.

Before committing to any loan, weighing all the possibilities thoroughly is vital.

Take advantage of TSB’s secured loan offerings with fixed and variable rates. Quickly check your eligibility for a tailored loan from the UK’s leading lenders.

TSB Contact Details:

Registered Office:

Henry Duncan House

120 George Street, Edinburgh

EH2 4LH

Scotland

Registered Number: SC95237

Financial Services Register number: 191240

https://www.tsb.co.uk/personal/