Are you looking for a secured loan option with fixed and variable rates? Norton Finance can help.

With loans ranging from £3,000 to £500,000 available, Norton Finance secured loans are the perfect solution for those living in the UK who need access to funds quickly.

We’ll assess the eligibility criteria and benefits/downsides of Norton Finance’s secured loans, allowing you to determine if this suits your circumstances.

Additionally, we’ll discuss alternatives if taking out a loan with Norton Finance isn’t what you’re looking for.

A new product from 1st February 2023, unavailable on the comparison engine sites, Norton Finance secured loans.

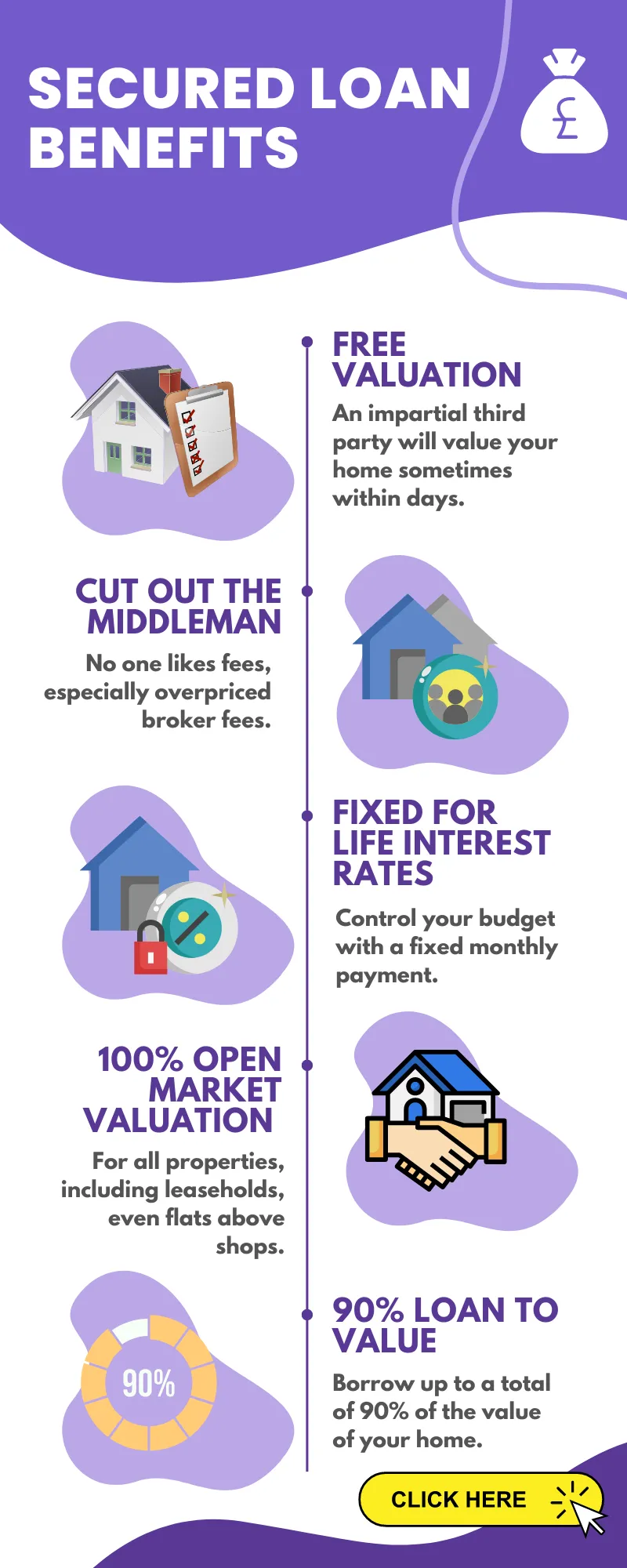

- Loan to value up to 90%

- You don’t need to be an existing Norton Finance customer

- A free no, obligation 3rd party property valuation

- 6.1% fixed for life

- Flats and other leaseholds have full open market valuations applied

- Keep your existing mortgage

- The term can be matched to your existing mortgage for up to 25 years

- No arrangement, product or completion fees

- No early redemption penalties

- Fast agreement in principle based on soft credit search that has no impact on your credit history

Please complete the initial no-obligation enquiry form:

What is Norton Finance?

Norton Finance is a UK-based loan provider that specialises in secured loans. Norton Finance, with decades of expertise in the industry, has become one of the most respected and reliable loan providers across Britain.

They offer competitive rates on their secured loans, which can be used, for example, home improvements, debt consolidation, or to fund a business venture.

The Benefits of Using Norton Finance:

When you take out a loan with Norton Finance, you will benefit from their low-interest rates and flexible repayment options.

The customer service team at Norton Finance are both friendly and knowledgeable, so they can assist you with any queries you may have.

Additionally, all applications are processed quickly and securely online, meaning there’s no need to visit branches or wait in line for an appointment.

Types of Loans Offered by Norton Finance:

Norton Finance offers both fixed rate and variable rate secured loans depending on individual circumstances.

Fixed rate loans enable customers to fix their interest rates for the entire loan term. In contrast, variable rate loans allow them to adjust payments in response to market changes and maintain a competitive APR of 4%.

Both types come with competitive APR (Annual Percentage Rate) starting at 4%.

With this in mind, let’s explore the eligibility requirements for securing a loan with Norton Finance.

How to Qualify for a Secured Loan with Norton Finance

Qualifying for a secured loan with Norton Finance is relatively straightforward. To be eligible, you must have enough equity in a UK property such as a house, flat or commercial building to cover the loan amount and provide proof of income and employment status.

Applicants must provide evidence of their earnings and job status to be eligible for a secured loan with Norton Finance.

In addition, creditors will assess your credit score as part of their decision; people with higher scores are more likely to be accepted for bigger loans at improved terms.

To determine your capacity to repay the loan, creditors will necessitate that you give info about any other liabilities you presently owe.

Additionally, when submitting an application for a secured loan with Norton Finance, you must furnish proof of address (utility bills), bank statements from the past three months, pay stubs or other evidence of income/employment status and copies of any existing mortgages on your property.

To qualify for a secured loan with Norton Finance, you must meet the eligibility requirements and provide all necessary documents.

Additionally, your creditworthiness will be assessed during the application process.

With that said, let us now look at some advantages of securing a loan with Norton Finance.

Advantages of Taking Out a Secured Loan with Norton Finance

Secured loans with Norton Finance offer several advantages to those seeking financing options.

One of the key advantages is that secured loans typically come with lower interest rates than unsecured ones, resulting in cost savings and quicker debt repayment.

Lower interest rates associated with secured loans can result in substantial savings over the loan’s lifetime, making it easier to pay off debt quickly. Furthermore, secured loans can be tailored to suit the borrower’s budget and lifestyle with flexible repayment options.

Finally, applying for a secured loan through Norton Finance is quick and easy, making it possible to get approved in as little as 24 hours after submitting all required documents.

Lower Interest Rates than Unsecured Loans:

Secured loans from Norton Finance typically have lower interest rates than unsecured personal or business loans from banks or credit unions due to the collateral used when taking out a loan—in this case, your home or other property, such as commercial property.

Fixed rate loans could save you much money in the long run, compared to variable-rate ones.

With Norton Finance’s secured loan products, customising your repayment schedule is a breeze.

Choose a repayment schedule that fits your needs, with monthly payments ranging from 3 to 25 years for fixed or variable rates; sometimes, longer terms may be available. The key here is flexibility – take advantage of it.

Once all documents have been appropriately filed, authorization should be accomplished within 24 hours before the funds are transmitted into your account. Thus, there is no need for apprehension about when the money will come.

A secured loan with Norton Finance can give you peace of mind from lower interest rates and flexible repayment options. However, it is important to consider the potential risks before committing to a secured loan with Norton Finance.

Disadvantages of Taking Out a Secured Loan with Norton Finance

When considering taking out a secured loan with Norton Finance, it is vital to understand the potential drawbacks.

A secured loan can be disadvantageous, as in the event of non-payment, there is a chance of forfeiting one’s residence or other property. If payments are not made on time or in full, the lender may have legal recourse to seize your collateral property.

An unsecured personal loan may come with a repayment period that can extend up to five years, contingent on the amount borrowed and other factors such as credit score and income level.

However, Norton Finance’s secured loans usually involve extended repayment periods spanning ten to thirty years. The borrower could forfeit their collateral if payments are not made on time.

It is critical to recognise the dangers of obtaining a secured loan from Norton Finance, for example, the likelihood of losing one’s assets if payments are not made on time.

However, alternatives may provide more favourable terms and conditions than a secured loan from Norton Finance.

Alternatives to Taking Out a Secured Loan with Norton Finance

Several options are available when considering alternatives to taking out a secured loan with Norton Finance.

For those who don’t want to put up any collateral, unsecured personal loans from banks and credit unions can be a great alternative to taking out a secured loan with Norton Finance.

These loans typically have lower interest rates than secured loans and offer flexible repayment terms. Additionally, they do not require collateral or any other form of security, making them ideal for those who don’t want to risk losing their property if they default on the loan.

Peer-to-peer lending platforms are another viable alternative to obtaining a secured loan with Norton Finance.

This type of platform connects borrowers directly with lenders to cut out the middleman and provide more competitive interest rates and repayment plans that may fit better into an individual’s budget.

With peer-to-peer lending, individuals can often borrow more significant amounts of money than what is offered by banks or credit unions without having to put up collateral as security against the loan amount borrowed.

Finally, home equity lines of credit (HELOC) are also an option when seeking an alternative form of financing compared to securing a loan through Norton Finance.

A HELOC allows homeowners access to funds based on the equity they have built up in their home over time – meaning you don’t need a perfect credit score or any other form of collateral like you would with most other types of loans.

Although HELOCs usually come with lower interest rates than unsecured personal loans, they are secured by the borrower’s house and can thus put it at risk if payments are not made.

FAQs about Norton Finance Secured Loans

What are the main disadvantages of a secured loan?

If you fail to make payments on a secured loan, the lender may take possession of your property.

Borrowers must ensure their repayment capacity before opting for a secured loan, as failure to pay may result in the lender seizing the collateral.

Additionally, repayment terms for secured loans may be longer than those of unsecured ones, leading to increased interest costs over time.

What is the risk of secured loans?

Secured loans involve a borrower using their property as collateral to secure the loan. Should the borrower default on payments, the lender may take possession of and sell the property to recoup their losses.

As such, there is a risk of losing your home or other assets if you fail to repay on time and in full.

Secured loans can offer lower rates than unsecured ones, making them a potential choice for those seeking fixed repayments at more reasonable prices.

Are Norton finance a direct lender?

No, Norton Finance is not a direct lender. They are an independent loan broker that works with a panel of lenders to provide customers with the best secured loan option for their individual circumstances.

Norton Finance searches through its partner lenders and finds the most suitable offer based on affordability, credit score and deposit requirements. Once an offer has been accepted, the customer must finalize all necessary documentation with their chosen lender to secure the loan.

Glossary:

1. Homeowner Loan:

A secured loan that uses the borrower’s home as collateral is typically used for major purchases or debt consolidation.

2. Second Mortgage:

A second loan against a property that is taken out in addition to an existing mortgage and secured by the same asset.

3. Equity Release Plan:

An agreement where homeowners can borrow money against their property without having to make monthly repayments on it until they pass away or move into long-term care accommodation permanently.

4. Bridging Loan:

A short-term loan allows borrowers to access funds quickly between buying and selling properties, often with a repayment period of up to 12 months from when the loan was taken out initially.

5. Commercial Property Loan:

Secured loans are designed specifically for businesses looking to purchase commercial premises such as offices, shops or warehouses, usually with longer terms than other types of finance available on the market today.

Conclusion

In conclusion, Norton Finance secured loans are a great way to access funds quickly and easily.

Norton Finance secured loans could be an optimal selection for those residing in the UK and possessing property. They offer a range of fixed or variable rates with the potential to borrow up to £500K.

While there may be disadvantages, these should always be weighed against your circumstances before making any decisions.

If you’re looking for alternatives, other loan options from banks or credit unions could also provide suitable solutions depending on your requirements.

Take advantage of Norton Finance’s competitive secured loan rates and quickly check your eligibility with our trusted panel of UK lenders. Get the financing you need today!

Norton Finance Contact Details:

Registered Office:

Norton House

Mansfield Road, Rotherham, South Yorkshire

S60 2DR

United Kingdom

Registered Number: 5995692

Financial Services Register Number: 589554

https://www.nortonfinance.co.uk/