Fast secured loans offer quick access to financing by using your valuable assets, such as your property or vehicle, as collateral.

These loans are popular among borrowers who need funds immediately for various purposes, including debt consolidation, home improvements, or business expenses.

A new product from April 2023, unavailable on the comparison engine sites, Fast UK secured loans.

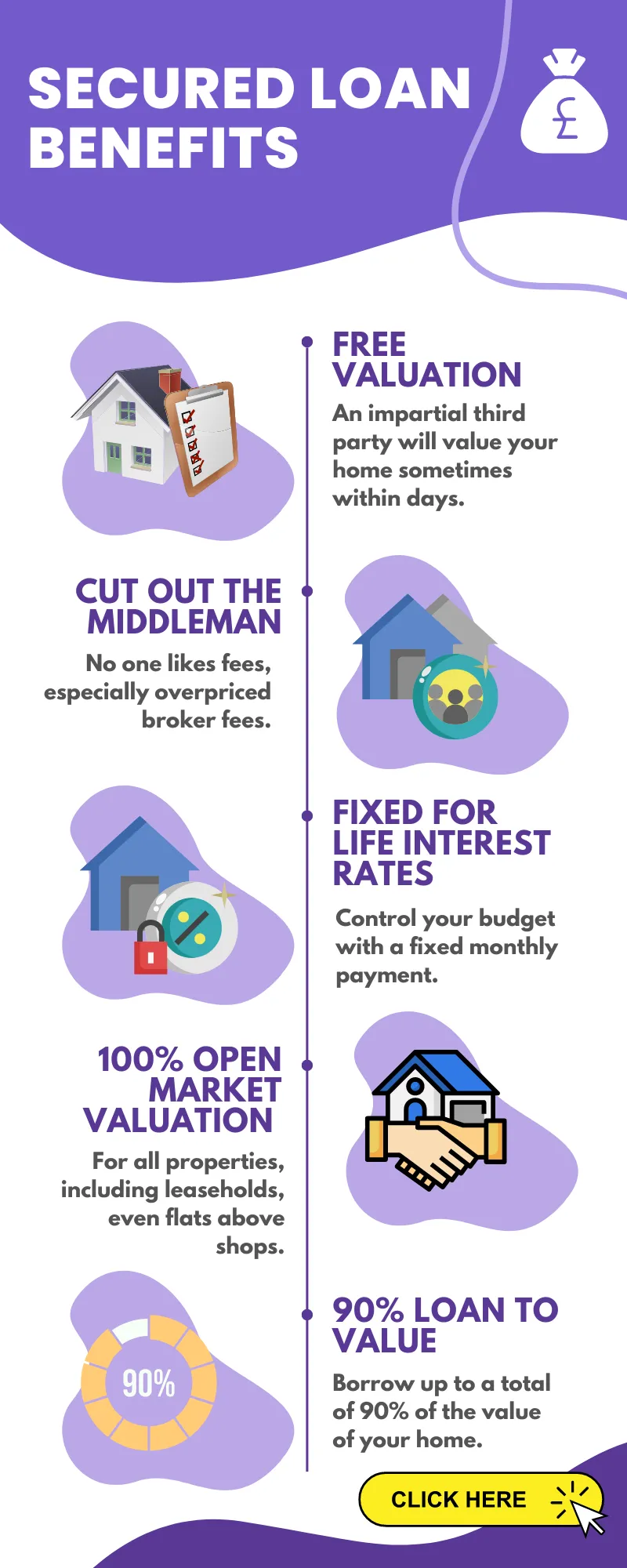

- Loan to value up to 90%

- A free no, obligation 3rd party property valuation

- 6.1% fixed for life

- Flats and other leaseholds have full open market valuations applied

- Keep your existing mortgage

- The term can be matched to your existing mortgage for up to 25 years

- No arrangement, product or completion fees

- No early redemption penalties

- Fast agreement in principle based on soft credit search that has no impact on your credit history

Please complete the initial no-obligation enquiry form:

How Fast Secured Loans Work

Fast secured loans are a type of borrowing that requires you to pledge an asset, typically your property or vehicle, as collateral. This collateral serves as a security for the lender, ensuring they will recover their investment if the borrower defaults on the loan repayments.

In case of non-payment, the lender has the legal right to repossess the pledged asset and sell it to recoup their losses. Due to the presence of collateral, fast secured loans often have lower interest rates and more flexible terms than unsecured loans.

Benefits of Fast Secured Loans

Access to Higher Loan Amounts

Secured loans allow you to borrow larger amounts of money, as the loan amount is directly tied to the value of your collateral. This makes fast secured loans ideal for significant expenses, such as home renovations or starting a new business venture.

Lower Interest Rates

The presence of collateral reduces the lender’s risk, resulting in lower interest rates for borrowers. This can help you save money on interest payments over the life of the loan.

Faster Approval Times

Fast secured loans are typically approved more quickly than unsecured loans due to the presence of collateral. Lenders can expedite the process, ensuring you can access funds as soon as possible.

Improved Credit Score

By responsibly managing your fast secured loan and making timely repayments, you can improve your credit score over time. This can make it easier to obtain future financing with more favourable terms.

Eligibility and Application Process

To qualify for a fast secured loan, you must meet certain eligibility requirements, such as:

- Proof of income

- A good credit score

- Ownership of a valuable asset

To apply, you must complete an application form and submit the necessary documentation, including proof of income, credit history, and collateral details.

The lender will then evaluate your application and decide whether to approve the loan based on your creditworthiness and the value of the pledged asset.

Comparing Fast Secured Loan Lenders

When searching for a fast secured loan, comparing different lenders is essential to find the best deal.

Consider the following factors:

- Interest rates

- Loan terms

- Fees and charges

- Reputation and customer reviews

By comparing lenders, you can identify the most competitive offers and choose the one that best suits your needs.

Interest Rates and Loan Terms

Fast secured loans come with varying interest rates and terms based on factors such as your credit score, loan amount, and the value of the collateral. Fixed and variable interest rates are available, with fixed rates providing stability and predictability, while variable rates may offer potential savings if market conditions improve.

Loan terms typically range from 1 to 30 years, depending on the loan purpose and the borrower’s ability to repay.

Selecting a loan term that suits your financial situation is crucial, as longer terms may result in lower monthly payments but higher overall interest costs.

| Loan Type | Collateral Required | Interest Rate (APR) | Loan Amount Range | Loan Term Range |

|---------------------|---------------------|---------------------|---------------------|--------------------|

| Secured Loans | Yes | 3.5% - 9.0% | £5,000 - £300,000 | 1 - 30 years |

| Unsecured Loans | No | 5.0% - 15.0% | £1,000 - £50,000 | 1 - 7 years |Paying Off Your Fast Secured Loan

To ensure the timely repayment of your fast secured loan, consider the following strategies:

- Create a repayment plan: Outline a clear repayment plan that factors your monthly income and expenses, and stick to it to avoid defaulting on your loan.

- Pay more than the minimum: Whenever possible, make additional payments towards your loan principal to reduce the interest costs and shorten the loan term.

- Refinancing: If you find a lender offering a lower interest rate, consider refinancing your loan to save on interest payments.

Potential Risks and Drawbacks

While fast secured loans offer numerous benefits, it’s essential to be aware of potential risks and drawbacks, including:

- Loss of collateral: Failing to make timely repayments could result in the loss of your pledged asset, which may have severe financial consequences.

- Higher overall interest costs: If you choose a long loan term, you may pay more in interest over the life of the loan.

- Impact on credit score: Defaulting on a UK secured loan can negatively affect your credit score, making it difficult to obtain future financing.

| Loan Type | Collateral Required | Interest Rate (APR) | Loan Amount Range | Loan Term Range |

|---------------------|---------------------|---------------------|---------------------|--------------------|

| Fast Secured Loans | Yes | 3.5% - 9.0% | £5,000 - £300,000 | 1 - 30 years |

| Unsecured Loans | No | 5.0% - 15.0% | £1,000 - £50,000 | 1 - 7 years |

| Credit Cards | No | 15.0% - 30.0% | N/A | N/A |

| HELOC | Yes | 4.0% - 8.0% | Up to 85% of equity | 5 - 30 years |These tables provide a comparison of secured loans and unsecured loans, as well as alternative financing options, highlighting key differences in collateral requirements, interest rates, loan amounts, and loan terms.

Alternatives to Fast Secured Loans

If a fast secured loan isn’t the best fit for your needs, consider these alternatives:

- Unsecured personal loans: These loans don’t require collateral but may have higher interest rates and lower borrowing limits.

- Credit cards: Credit cards offer a revolving line of credit, which may be suitable for short-term financing needs.

- Home equity line of credit (HELOC): A HELOC allows you to borrow against the equity in your home, offering flexible access to funds for various purposes.

Conclusion

Fast secured loans provide a convenient financing option for borrowers needing immediate funds.

By carefully considering the benefits, risks, and available alternatives, you can decide whether a fast secured loan is the right choice for your financial needs.

Remember to compare lenders, evaluate loan terms, and develop a sound repayment strategy to ensure a successful borrowing experience.

Frequently Asked Questions About Fast Secured Loans

What types of collateral can I use for a fast secured loan?

The most common types of collateral for fast secured loans are real estate properties and vehicles. However, some lenders may accept other valuable assets, such as stocks, bonds, or valuable collectables. The type of collateral accepted depends on the lender’s policies and the asset’s value.

Can I apply for a fast secured loan with a poor credit score?

While having a good credit score increases your chances of getting approved for a fast secured loan, some lenders may still consider your application if you have a poor credit score.

The collateral’s value can offset the risk of lending to borrowers with a lower credit rating. Remember that you may face higher interest rates and stricter loan terms if your credit score is not ideal.

How quickly can I receive the funds from a fast secured loan?

The approval and funding process for fast secured loans varies depending on the lender and the complexity of your application.

You may sometimes receive the funds within a few days of submitting your application. However, it can take longer if the lender requires additional documentation or needs to conduct a more thorough evaluation of your collateral.

Can I use a fast secured loan to consolidate debt?

Yes, one of the common uses of fast secured loans is to consolidate high-interest debts, such as credit card balances or unsecured personal loans. By consolidating your debts into a single secured loan with a lower interest rate, you can potentially save money on interest payments and simplify your monthly repayments.

Are there any fees associated with fast secured loans?

Fees associated with secured loans may include origination fees, appraisal fees, and closing costs. These fees vary by lender and should be considered when comparing loan offers. Be sure to inquire about any additional fees before finalizing your loan agreement to avoid unexpected charges.

What happens if I cannot repay my fast secured loan?

If you fail to make timely repayments on your UK secured loan, the lender has the legal right to repossess the pledged asset to recover their losses.

This may result in collateral loss and negatively impact your credit score. Creating a repayment plan and communicating with your lender if you encounter any financial difficulties to avoid these consequences is essential.