If you’re seeking a loan without having to provide collateral, Barclays unsecured personal loans may be the solution.

With fixed interest rates and no need to secure your loan with assets, these loans offer an attractive option for financing big purchases or consolidating debt.

Read on to learn more about why taking out a Barclays unsecured personal loan could be right for you, how to apply, repayment options available and some of the advantages of this type of borrowing.

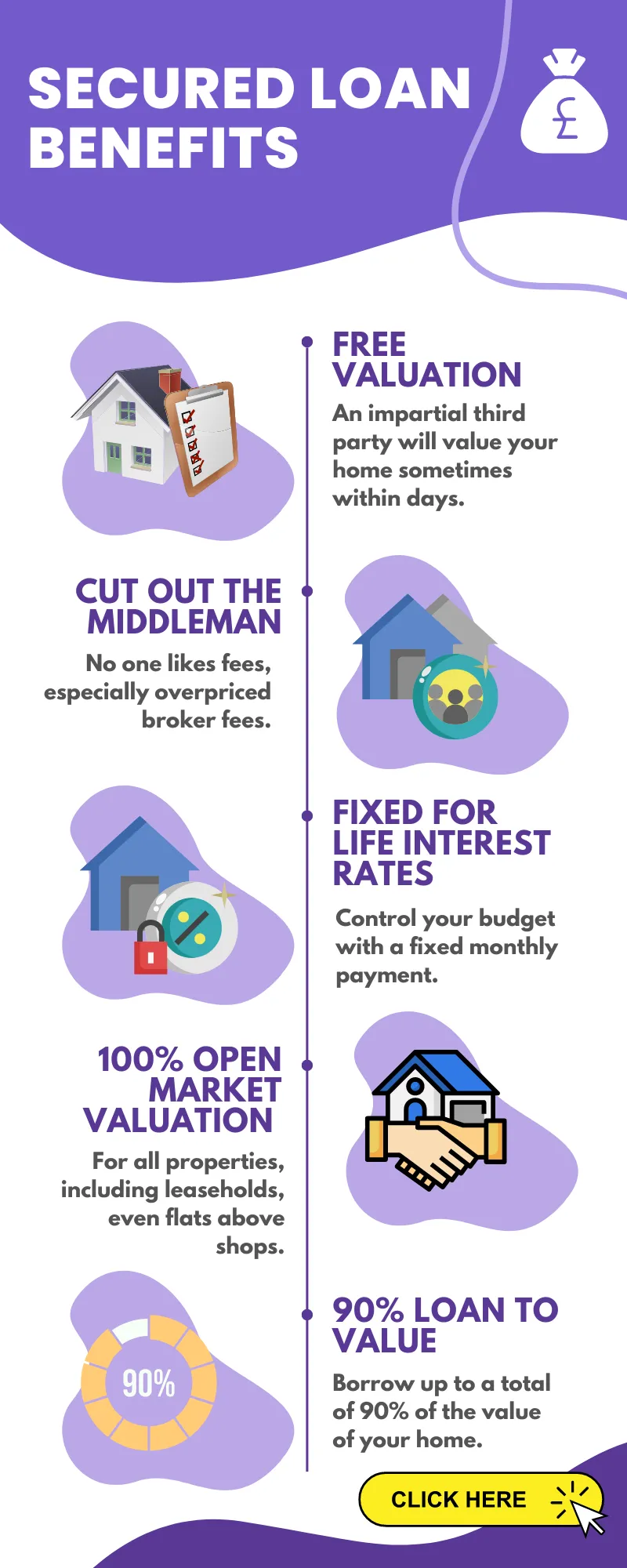

A new product from 1st February 2023, unavailable on the comparison engine sites, Barclays secured loans.

- Loan to value up to 90%

- You don’t need to be an existing Barclays customer

- A free no, obligation 3rd party property valuation

- 6.1% fixed for life

- Flats and other leaseholds have full open market valuations applied

- Keep your existing mortgage

- The term can be matched to your existing mortgage for up to 25 years

- No arrangement, product or completion fees

- No early redemption penalties

- Fast agreement in principle based on soft credit search that has no impact on your credit history

Please complete the initial no-obligation enquiry form:

Benefits of Barclays Unsecured Personal Loans

Barclays Unsecured Personal Loans offer a range of benefits to individuals living in the UK who own a house, flat, or commercial property.

With fixed interest rates and fast and straightforward loan eligibility checks, you can get access to the funds you need quickly and easily.

Fixed Interest Rates:

Barclays Unsecured Personal Loans provide customers with fixed interest rates guaranteed for the life of their loan.

With a fixed rate, your monthly payments will remain constant throughout the loan term, allowing for more effective financial planning without worrying about changes in interest.

Fast and Simple Loan Eligibility Check:

Applying for an unsecured personal loan from Barclays is quick and easy. You’ll be able to check if you’re eligible for a loan within minutes using their online application form – no lengthy paperwork is required.

The bank’s automated system will assess your creditworthiness before providing a provisional limit on how much money they can lend you based on your individual circumstances.

Once approved by Barclays’ automated system, customers are provided with a provisional limit indicating how much money they could borrow from them once their full application has been completed and reviewed by underwriters.

This gives applicants peace of mind knowing precisely what kind of financial commitment they’re making before submitting their final documents, saving time and stress.

The benefits of Barclays Unsecured Personal Loans include fixed interest rates, fast and straightforward loan eligibility checks, and a provisional loan limit before applying.

Applying for a loan is straightforward; here’s a guide.

How to Apply for a Barclays Unsecured Personal Loan

Before applying, it’s essential to gather all the documents the lender requires.

These may include proof of income, bank statements, credit reports, and other financial information. Once the paperwork is prepared, you can either electronically submit your application or visit one of their physical locations.

When submitting an online form, ensure all the data you enter is precise and current.

When completing the application process, you must also provide a valid form of identification, such as a driver’s license or passport number. Once your application is submitted, you will be contacted within 24 hours with further details about the status of your loan request if approved.

If visiting a branch, bring all necessary documentation, such as proof of income and bank statements, to the in-person meeting so that Barclays Bank can assess whether you are eligible for a loan product.

During this meeting, they will also discuss any questions you may have about the terms and conditions associated with taking out a loan from Barclays Bank UK PLC before providing approval (or rejection) based on your individual circumstances.

Once approved, customers can select a repayment option that best suits their financial needs, either fixed monthly payments or early repayment options, without any extra fees.

Applying for a Barclays Unsecured Personal Loan is easy and straightforward, so take advantage of this great opportunity.

Exploring the potential of a Barclays Unsecured Personal Loan is worth considering, so here are some reasons to look into it.

Reasons to Take Out an Unsecured Personal Loan

Debt Consolidation:

An unsecured personal loan from Barclays can be a great way to consolidate your debt. By consolidating all your debts into one loan with a fixed interest rate, you can make managing and paying off debt easier while potentially reducing the amount of interest paid.

By consolidating your debt, you could save on interest and make the repayment process easier. Making your payments in full and on time each month could lead to a higher credit score eventually.

Home Improvements and vehicle purchases:

If you’re looking to spruce up your home but don’t have the funds for the project, an unsecured personal loan from Barclays may be just what you need.

Whether it’s a new kitchen or bathroom renovation, landscaping updates or interior decorating changes – an unsecured personal loan gives you access to the funds needed without putting down any collateral, such as property or assets.

Buying a new car is often out of reach financially for many people unless they can take out some financing option, such as an unsecured personal loan from Barclays.

Unsecured loans provide quick access to cash so customers can purchase their dream vehicle without waiting for enough savings.

Moreover, the amount borrowed can be unrestricted, making them an ideal choice for buying costly items like cars.

An unsecured personal loan may be a viable option for debt consolidation, home renovations or purchasing an automobile.

With Barclays Unsecured Personal Loans, you can have fixed monthly payments and early repayment options, giving you more flexibility with your finances.

Repayment Options for Barclays Unsecured Personal Loans

You have two repayment options when taking out an unsecured personal loan with Barclays.

The first repayment option with Barclays unsecured personal loans is a fixed monthly payment, which involves the amount paid each month until the loan has been completely cleared.

This type of repayment plan gives borrowers peace of mind knowing exactly how much they need to pay and when. The second option available for unsecured personal loans with Barclays is early repayment.

Borrowers can repay their loan in full or partially before its term is up without additional fees or penalties, allowing them to save on interest charges and reduce what they owe. Early repayment can help cut costs on interest and decrease the total sum owed for the loan.

Staying on top of payments is key to maintaining a good credit score and potentially qualifying for better rates.

It is also important to be familiar with all the loan’s terms and conditions to avoid being caught off guard later on.

If experiencing any monetary difficulty during the loan tenure, it is advised to contact Barclays quickly for potential help; depending on the situation, they may be able to adjust your debt or prolong your payment plan.

If opting for early repayment instead, tracking how much has been repaid over time is vital so that one does not exceed their budgeted amount by accidentally paying too much too soon.

Furthermore, if possible, try paying more than just minimum payments every month; doing so could potentially reduce both overall interest costs and total principal balance owing faster than expected, saving money in both cases.

Lastly, always read through all paperwork provided by Barclays carefully before signing anything – understanding what is being agreed upon beforehand helps avoid potential issues further down the line should something go awry unexpectedly after signing the contract.

Repayment options for Barclays Unsecured Personal Loans provide flexibility and convenience to borrowers, allowing them to make fixed monthly payments or opt for early repayment.

With many advantages available, taking out an unsecured personal loan with Barclays is worth considering.

Advantages of Taking Out an Unsecured Personal Loan with Barclays

When considering an unsecured personal loan, Barclays offers a range of advantages that make it an excellent option for UK homeowners.

With low APR representative rates, no collateral required and flexible terms and conditions, taking out an unsecured loan with Barclays can help you achieve your financial goals.

The APR, a measure of the cost of borrowing money from a lender annually, is often competitively low when taking out an unsecured loan with Barclays.

Barclays offers competitively low APRs on unsecured loans, making them more affordable than other options. This means you’ll pay less interest overall when taking out an unsecured loan with Barclays compared to other lenders in the market.

No Collateral Required:

Unlike secured loans which require some form of collateral such as property or savings to secure the loan amount against defaulting on repayments, unsecured loans do not require any security deposit or asset pledge from borrowers.

This makes it easier for those who may not have access to assets they could use as collateral but still need funds quickly without worrying about risking their existing assets if they cannot keep up with repayment schedules.

With Barclays unsecured personal loans, customers can tailor their repayment schedule according to their circumstances and budget requirements.

The payment terms typically range from one to five years, with early repayment options available should they wish to settle the balance ahead of time without additional fees or charges.

This allows borrowers to keep their monthly payments manageable while providing them with a way out if needed.

Overall, by opting for an unsecured personal loan with Barclays, customers can enjoy lower interest rates, greater flexibility in terms and conditions, and no requirement to provide any collateral – all while backed by one of Britain’s largest banking institutions.

FAQs about Barclays Unsecured Personal Loans

Does Barclay give personal loans?

No, Barclay does not offer personal loans. Instead, they provide secured loans with fixed and variable rates for customers in the UK who own a house, flat or commercial property. Customers can use an online eligibility check to find out if their loan application is eligible for approval from one of their panel of lenders.

What is a good reason to get an unsecured personal loan?

An unsecured loan can be a great way to access funds quickly and easily without putting up any collateral.

An unsecured loan can be a practical solution for unexpected costs that require immediate attention rather than waiting until the next pay period.

The repayment terms are usually fixed, making budgeting and managing payments over time easier.

What is the interest rate on a personal loan at Barclays?

Various factors, including credit rating, determine the interest rate for a personal loan at Barclays, income and amount borrowed.

Generally, their fixed-rate loans range from 3.5% to 5%, while variable rates start at 4%.

The actual rate you receive may be higher or lower, depending on your individual circumstances. To get an accurate quote for a personal loan with Barclays, please get in touch with them directly for more information.

Does Barclays loan affect credit score?

Taking out a loan from Barclays will affect your credit score. When you take out a loan, lenders look at your credit report to decide whether or not they are willing to lend money to you.

Taking out a loan that exceeds your income and existing debts can have a negative effect on your credit score. However, regular payments towards the loan in full and on time may help to improve it.

Yet, if the loaner perceives that you can promptly make consistent payments on your debt, this could potentially boost your credit score.

Conclusion

Barclay’s unsecured personal loans offer a range of benefits and advantages, from the convenience of applying online to flexible repayment options.

With an APR representative rate as low as 3.5%, it is easy to see why Barclays unsecured personal loans are becoming increasingly popular for those looking for debt consolidation, home improvements, or even buying a new car.

Think about a Barclays unsecured personal loan if you need some extra money.

Take control of your finances with a Barclays unsecured personal loan. Get started today and find out if you’re eligible for competitive rates, flexible terms, and fast approval!

Barclays Contact Details:

Registered Office:

1 Churchill Place

London

E14 5HP

United Kingdom

Registered Number: 9740322

Financial Services Register number: 759676

https://www.barclays.co.uk/important-information/